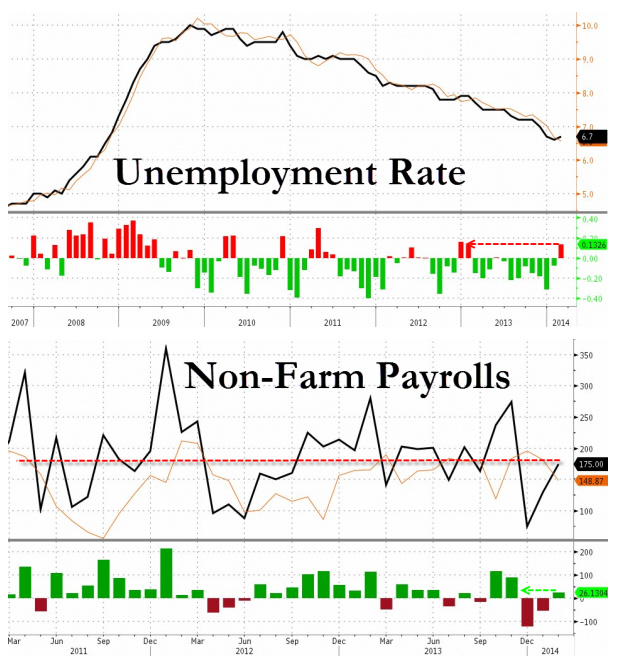

Die AL-Quote steigt auf 6,7 % (erw. 6,6 %, zuvor 6,6 %)

So much for the weather. As we warned earlier today, when we said that with everyone expecting a miserable print the only possible result would be a large "beat", sure enough that's precisely what happened. Breaking it down:

February payrolls: +175K, Exp. 149K, Last revised from 113K to 129K).

Household survey jobs added: 42K, far less than the Household survey.

Unemployment rate: 6.7%, Exp. 6.6%, Last 6.6%.

Labor participation rate: 63.0%, Last 63.0%

Private payrolls: 162K, Exp. 145K, Last 145K

Manufacturing payrolls: 6K, Exp. 5K, Previous revised from 21K to 6K

www.zerohedge.com/news/2014-03-07/...-149k-unemployment-rate-rises-67

Marktreaktion darauf:

The knee-jerk reaction to a better-than-expected (and entirely noise-driven) payroll number (with a rise in the unemployment rate) is a rip higher in stocks and collapse in bonds and precious metals. The USD is surging as USDJPY instantly hit 103.50 (breaking through its 50DMA) providing all the juice stocks need to test that critical Goldman 1,900 year-end target for the S&P 500. It seems, just as we warned earlier, "whatever the number, the algos will send stocks higher - that much is given in a blow off top bubble market in which any news is an excuse to buy more."

ZH

(Verkleinert auf 88%)