DirectBooks Welcomes Scotiabank, Rabo Securities and Huntington Capital Markets

PR Newswire

NEW YORK, June 7, 2021

NEW YORK, June 7, 2021 /PRNewswire/ -- DirectBooks, the capital markets consortium founded to optimize global financing markets, today announced that Scotiabank, Rabo Securities and Huntington Capital Markets have joined the DirectBooks platform. The addition of these dealers increases the sell-side participation to fifteen firms. The platform was launched in Q4 2020 with deal announcement functionality for U.S. Dollar Investment Grade issuances globally with the recent addition of Euro and Sterling deals in April 2021. Onboarding of additional underwriters and institutional investors will continue throughout 2021.

"DirectBooks is excited to welcome Scotiabank, Rabo Securities and Huntington, as we continue on our path to establishing a broad and diverse global community of underwriters," said DirectBooks CEO, Rich Kerschner.

"Scotiabank is committed to meeting the evolving needs of our clients and to providing a best-in-class client experience," said Paul McKeown, Managing Director and Head of U.S. Debt Capital Markets, Scotiabank. "We are pleased to have the opportunity to leverage this integrated solution from DirectBooks that advances the new issuance process, which will help us provide greater support for our clients."

"Rabo Securities is very pleased to join DirectBooks. We are constantly looking for innovative ways to support our clients, and this platform is a logical next step in the evolution of capital markets," said Jan Hendrik de Graaff, Head Investment Grade Capital Markets, Rabo Securities. "We're excited to offer institutional investors an enhanced service and new issuance experience."

"As the new issuance market continues to evolve, Huntington is committed to participating in solutions that simplify and automate processes for our clients," said Matt Milcetich, Executive Managing Director of Huntington Capital Markets. "We are excited to join the DirectBooks community to streamline the deal process and bring greater efficiencies to the primary market."

DirectBooks is simplifying the primary issuance process for fixed income by streamlining communications workflows for underwriters and institutional investors. The platform will continue to expand with the capability to optimize the communications of order and allocation information, hedging instructions and final deal documentation. High Yield and Emerging Markets issuances will be added to the platform later this year.

ARIVA.DE Börsen-Geflüster

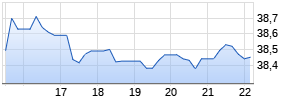

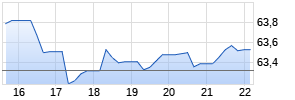

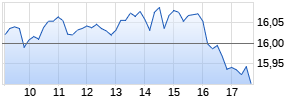

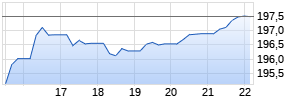

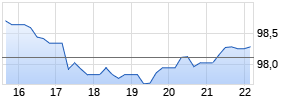

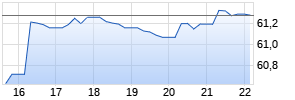

Kurse

|

|

|

|

|

|

|

|

|

ABOUT DIRECTBOOKS

DirectBooks leverages its technology expertise and market knowledge to optimize global financing markets. We are simplifying the primary issuance process for fixed income by streamlining communications workflows for underwriters and institutional investors. DirectBooks was formed by 9 global banks, consisting of Bank of America (NYSE: BAC), Barclays (NYSE: BCS), BNP Paribas (FR: BNP), Citi (NYSE: C), Deutsche Bank (NYSE: DB), Goldman Sachs (NYSE: GS), J.P. Morgan (NYSE: JPM), Morgan Stanley (NYSE: MS), Wells Fargo (NYSE: WFC). A complete list of participating underwriting firms can be found on our website. For additional information, please visit www.DirectBooks.com.

ABOUT RABOBANK

Rabobank Group is a global financial services leader providing wholesale and retail banking, leasing, and real estate services in more than 40 countries worldwide. Founded over a century ago, Rabobank today is one of the world's largest banks with over $640 billion in assets. In the Americas, Rabobank is a premier bank to the food, agribusiness and beverage industry, providing sector expertise, strategic counsel and tailored financial solutions to clients across the entire food value chain. Securities-related activities are conducted through Rabo Securities USA, Inc., Rabobank's U.S.-registered broker-dealer. Additional information is available on our website or on our social media platforms, including Twitter and LinkedIn.

ABOUT HUNTINGTON CAPITAL MARKETS

Huntington Bancshares Incorporated is a regional bank holding company headquartered in Columbus, Ohio, with $126 billion of assets and a network of 814 full-service branches, including 11 Private Client Group offices, and 1,314 ATMs across seven Midwestern states. Founded in 1866, The Huntington National Bank and its affiliates provide consumer, small business, commercial, treasury management, wealth management, brokerage, trust, and insurance services. Huntington also provides vehicle finance, equipment finance, national settlement, and capital market services that extend beyond its core states. Visit huntington.com for more information.

MEDIA CONTACT:

Chris Rodriguez

Chris.Rodriguez@DirectBooks.com

(848) 888-7704

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/directbooks-welcomes-scotiabank-rabo-securities-and-huntington-capital-markets-301306341.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/directbooks-welcomes-scotiabank-rabo-securities-and-huntington-capital-markets-301306341.html

SOURCE DirectBooks

Mehr Nachrichten zur Deutsche Bank Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.