McDONALD'S REPORTS FIRST QUARTER 2024 RESULTS

PR Newswire

CHICAGO, April 30, 2024

- Global comparable sales have grown nearly 2% for the quarter, marking 13 consecutive quarters of positive comparable sales growth

- Consolidated revenues for the quarter were more than $6 billion, an increase over prior year of over 4% in constant currencies

- Systemwide sales* to loyalty members across 50 loyalty markets were nearly $25 billion for the trailing twelve-month period and over $6 billion for the quarter

CHICAGO, April 30, 2024 /PRNewswire/ -- McDonald's Corporation today announced results for the first quarter ended March 31, 2024.

"Our global comparable sales growth in the first quarter marks 13 consecutive quarters of positive comparable sales growth with 30% growth over the last 4 years," said CEO Chris Kempczinski. "As consumers are more discriminating with every dollar that they spend, we will continue to earn their visits by delivering leading, reliable, everyday value and outstanding execution in our restaurants. As we look to the rest of 2024 and beyond, we remain focused on leveraging the competitive advantages within our Accelerating the Arches plan and growing QSR market share to drive long-term growth."

First quarter financial performance:

- Global comparable sales increased 1.9%, reflecting positive comparable sales in the U.S. and International Operated Markets segment. Comparable sales in the International Developmental Licensed Markets segment were slightly negative as the segment continued to be impacted by the war in the Middle East:

-

- U.S. increased 2.5%

-

- International Operated Markets segment increased 2.7%

-

- International Developmental Licensed Markets segment decreased 0.2%

- International Developmental Licensed Markets segment decreased 0.2%

- Consolidated revenues increased 5% (4% in constant currencies).

- Systemwide sales increased 3% (3% in constant currencies).

- Consolidated operating income increased 8% (8% in constant currencies). Results reflected pre-tax charges of $35 million and $180 million for the current year and prior year, respectively, primarily related to restructuring charges associated with Accelerating the Organization. Excluding these current and prior year charges, consolidated operating income increased 2% (2% in constant currencies).**

- Diluted earnings per share was $2.66, an increase of 9% (9% in constant currencies). Excluding the current year charges described above of $0.04 per share, diluted earnings per share was $2.70, an increase of 2% (2% in constant currencies) when also excluding prior year charges.**

| *Refer to page 3 for a definition of Systemwide sales. |

| **Refer to page 2 for additional details on charges for the first quarter 2024 and 2023. |

1

| | ||||||||||||||||||||

| | ||||||||||||||||||||

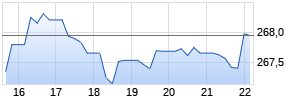

| COMPARABLE SALES ARIVA.DE Börsen-GeflüsterWerbung Weiter abwärts?

Vontobel

Den Basisprospekt sowie die Endgültigen Bedingungen und die Basisinformationsblätter erhalten Sie hier: VV8YBS,VU1L9V,. Beachten Sie auch die weiteren Hinweise zu dieser Werbung. Der Emittent ist berechtigt, Wertpapiere mit open end-Laufzeit zu kündigen.

Kurse

| ||||||||||||||||||||

| | | Increase/(Decrease) | ||||||||||||||||||

| | | Quarters Ended March 31, | ||||||||||||||||||

| | | 2024 | | 2023 | ||||||||||||||||

| U.S. | | 2.5 % | | 12.6 % | ||||||||||||||||

| International Operated Markets | | 2.7 | | 12.6 | ||||||||||||||||

| International Developmental Licensed Markets | | (0.2) | | 12.6 | ||||||||||||||||

| Total | | 1.9 % | | 12.6 % | ||||||||||||||||

- U.S.: Comparable sales results benefited from average check growth driven by strategic menu price increases. Successful restaurant level execution, effective marketing campaigns featuring the core menu and continued digital and delivery growth contributed to positive comparable sales results.

- International Operated Markets: Segment performance was driven by positive comparable sales in most markets, led by the U.K. and Germany, partly offset by negative comparable sales in France.

- International Developmental Licensed Markets: The continued impact of the war in the Middle East more than offset positive comparable sales in Japan, Latin America and Europe.

| KEY FINANCIAL METRICS - CONSOLIDATED Dollars in millions, except per share data

| |||||||||

| | Quarters Ended March 31, | ||||||||

| | 2024 | | 2023 | | Inc/ (Dec) | | | Inc/ (Dec) Excluding Currency Translation | |

| Revenues | $ 6,169 | | $ 5,898 | | 5 | % | | 4 | % |

| Operating income | 2,736 | | 2,532 | | 8 | | | 8 | |

| Net income | 1,929 | | 1,802 | | 7 | | | 7 | |

| Earnings per share-diluted | $ 2.66 | | $ 2.45 | | 9 | % | | 9 | % |

Results included pre-tax charges of $35 million, or $0.04 per share, for the three months ended 2024 and $180 million, or $0.18 per share, for the three months ended 2023, primarily related to restructuring charges associated with the Company's internal effort to modernize ways of working (Accelerating the Organization).

Excluding the above items, results reflected positive operating performance driven primarily by higher sales-driven Franchised margins, partly offset by higher Selling, general, and administrative expenses.

| NET INCOME AND EARNINGS PER SHARE-DILUTED RECONCILIATION Dollars in millions, except per share data

| |||||||||||||||||||

| | Quarters Ended March 31, | | |||||||||||||||||

| | Net Income | | Earnings per share - diluted | ||||||||||||||||

| | 2024 | | 2023 | | Inc/ (Dec) | | | Inc/ (Dec) Excluding Currency Translation | | | 2024 | | 2023 | | Inc/ (Dec) | | | Inc/ (Dec) Excluding Currency Translation | |

| GAAP | $ 1,929 | | $ 1,802 | | 7 | % | | 7 | % | | $ 2.66 | | $ 2.45 | | 9 | % | | 9 | % |

| (Gains)/charges | 27 | | 134 | | | | | | | | 0.04 Werbung Mehr Nachrichten zur McDonald's Corp. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | ||||||||