BetterInvesting™ Magazine Selects Apple as "Growth" Stock and Citigroup as "Undervalued" For December 2021 Issue

PR Newswire

TROY, Mich., Oct. 4, 2021

TROY, Mich., Oct. 4, 2021 /PRNewswire/ -- The Editorial Advisory and Securities Review Committee of BetterInvesting Magazine today announced Apple Inc. (NASDAQ: AAPL) as its "Stock to Study" and Citigroup (NYSE: C) as its "Undervalued Stock" in the December 2021 issue for investors' informational and educational use.

"Given the recent volatility in the stock market, the Committee reiterated today the need for thorough study and wise selection, adhering to BetterInvesting proven principle #3: Buy stock in high-quality growth companies. To achieve long-term growth and thereby succeed in achieving one's financial goals, evaluation of the fundamentals of individual companies by investors is imperative," said Ken Zendel, CEO of the National Association of Investors (NAIC), the parent organization of BetterInvesting.

Learn more including Common Traits of the Best Stocks at: https://www.betterinvesting.org/learn-about-investing/investor-education/getting-started-with-stocks/common-traits-of-the-best-stocks

Check the December 2021 issue of BetterInvesting Magazine for more details about the latest stock selections. Go to the trial version of BetterInvesting's online stock selection and analysis tools to study the investment potential of Apple and Citigroup by viewing their fundamental data and applying judgments.

Committee members are Robert M. Bilkie, Jr., CFA; Daniel J. Boyle, CFA; Marisa Bradbury, CFA; Philip Keating, CFA; Walter J. Kirchberger, CFA; and Anne Nichols, CFA.

As stated, the BetterInvesting committee's Stock to Study and Undervalued Stock choices are for the informational and educational uses of investors and are not intended as investment recommendations. BetterInvesting urges investors to educate themselves about the stock market so they can make informed decisions about stock purchases.

About BetterInvesting:

ARIVA.DE Börsen-Geflüster

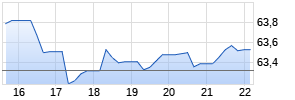

Weiter abwärts?

| Kurzfristig positionieren in Citigroup | ||

|

UM2FF7

| Ask: 0,36 | Hebel: 4,27 |

| mit moderatem Hebel |

Zum Produkt

| |

BetterInvesting™, a national 501(c)(3) nonprofit, investment education organization, has been empowering everyday Americans since 1951. Also known as the National Association of Investors™ (NAIC®), we have helped more than 5 million people from all walks of life learn how to improve their financial future. BetterInvesting provides unbiased, in-depth investing education and powerful online stock analysis tools to create successful lifelong investors. BetterInvesting staff, along with a dedicated community of volunteers across America, teach the organization's principles and time-tested methodology to individuals and investment clubs. For more information about BetterInvesting, please visit www.betterinvesting.org

Follow us on LinkedIn, Instagram and Facebook.

Contact: 877-275-6242

![]() View original content:https://www.prnewswire.com/news-releases/betterinvesting-magazine-selects-apple-as-growth-stock-and-citigroup-as-undervalued-for-december-2021-issue-301392354.html

View original content:https://www.prnewswire.com/news-releases/betterinvesting-magazine-selects-apple-as-growth-stock-and-citigroup-as-undervalued-for-december-2021-issue-301392354.html

SOURCE National Association of Investors/BetterInvesting

Mehr Nachrichten zur Citigroup Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.