EDWARDS LIFESCIENCES REPORTS THIRD QUARTER RESULTS

PR Newswire

IRVINE, Calif., Oct. 25, 2023

IRVINE, Calif., Oct. 25, 2023 /PRNewswire/ -- Edwards Lifesciences (NYSE: EW) today reported financial results for the quarter ended Sept. 30, 2023.

- Q3 sales grew 12 percent to $1.48 billion; constant currency1 sales grew 11 percent

- Q3 TAVR sales grew 11 percent; constant currency sales grew 10 percent

- Q3 EPS of $0.63; adjusted1 EPS of $0.59

- Received CE Mark for EVOQUE, the first transfemoral tricuspid replacement system

- Received approval for PASCAL Precision system in Japan

- Received CE Mark for MITRIS RESILIA surgical mitral valve

- Completed pivotal trial enrollment for SAPIEN M3, the first transfemoral mitral replacement system

- Reiterated full year 2023 financial guidance of 10 to 13 percent constant currency sales growth

"We are pleased with our strong third quarter performance, which included multiple new therapy approvals for the treatment of patients globally and important achievements on clinical milestones, as well as another quarter of double-digit sales growth," said Bernard Zovighian, CEO. "The increasing demand for our advanced technologies, coupled with the successful execution of our innovation strategy, gives us confidence in the tremendous opportunity to address unmet patient needs and drive differentiated long-term value."

Transcatheter Aortic Valve Replacement (TAVR)

For the quarter, the company reported TAVR sales of $961 million, which grew 11 percent versus the prior year, or 10 percent on a constant currency basis. The company's U.S. and OUS sales growth rates were comparable. Globally, on a constant currency basis, the company's average selling prices were stable.

In the U.S., Edwards' TAVR sales were in-line with overall procedure growth and driven by the continued successful launch of the SAPIEN 3 Ultra RESILIA valve.

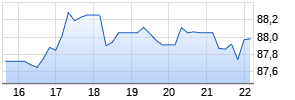

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Edwards Lifesciences Corp | ||

|

VM64BX

| Ask: 1,05 | Hebel: 6,50 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

"After more than 20 years of rigorous clinical experience and over 1 million patients treated, TAVR with SAPIEN is now a highly effective standard of care for patients suffering from aortic heart valve failure," said Larry Wood, group president of TAVR and Surgical Structural Heart. "We remain focused on improving diagnosis and treatment of the many more patients who remain untreated."

The combination of Edwards' global TAVR leadership, along with the data presented at TCT, gives the company further confidence in the future of TAVR and the company's expectation of a $10 billion opportunity by 2028.

Transcatheter Mitral and Tricuspid Therapies (TMTT)

Third quarter sales were $52 million, driven by accelerated adoption of the PASCAL Precision system, overall transcatheter edge-to-edge repair procedure growth and activation of more centers across Europe and the U.S.

As previously announced, the company received CE Mark for the EVOQUE tricuspid valve replacement system. This groundbreaking therapy will be introduced to patients in Europe through a disciplined launch that will focus on ensuring excellent outcomes. In addition, earlier this month, Edwards received approval in Japan for the PASCAL Precision system to treat patients with degenerative mitral regurgitation. The company also completed the enrollment in the ENCIRCLE pivotal trial, studying patients treated with Edwards' innovative SAPIEN M3 transfemoral mitral valve replacement therapy.

Surgical Structural Heart and Critical Care

Surgical Structural Heart sales for the quarter were $247 million, which grew 12 percent, or 11 percent on a constant currency basis. The growth was driven by a balanced combination of strong adoption of Edwards' premium RESILIA products and overall procedure growth.

Critical Care sales for the quarter were $221 million, which grew 7 percent, or 6 percent on a constant currency basis. Sales growth was led by the Smart Recovery technology portfolio and strong adoption of the Acumen IQ sensor equipped with the Hypotension Prediction Index algorithm.

Additional Financial Results

For the quarter, the adjusted gross profit margin was 76.4 percent, compared to 81.0 percent in the same period last year. This year-over-year reduction was driven by impacts from foreign exchange. Last year, Edwards' gross profit margin was lifted by an unusually positive impact from foreign exchange.

Selling, general and administrative expenses in the third quarter were $440 million, or 29.7 percent of sales, compared to $377 million in the prior year. This increase was driven by investments in transcatheter field-based personnel in support of the company's growth strategy and performance-based compensation.

Research and development expenses in the third quarter were $270 million, or 18.3 percent of sales, compared to $234 million in the prior year. This increase was primarily the result of continued investments in the company's transcatheter valve innovations, including increased clinical trial activity.

Free cash flow for the third quarter was $356 million, defined as cash flow from operating activities of $411 million, less capital spending of $55 million.

Cash, cash equivalents and short-term investments totaled $1.9 billion as of Sept. 30, 2023. During the third quarter, the company repurchased approximately $174 million of stock through a pre-established 10b5-1 program. Total debt was approximately $600 million.

Outlook

Edwards' full-year sales guidance remains unchanged for both the total company and each product group. The company continues to expect full-year total company and TAVR sales growth to be in the 10 to 13 percent range on a constant currency basis.

Additionally, the company continues to expect full year 2023 adjusted earnings per share of $2.50 to $2.60. For the fourth quarter of 2023, the company projects total sales to be between $1.45 and $1.53 billion and diluted earnings per share of $0.60 and $0.66.

"We are confident in our focused and differentiated strategy given heart valve failure is largely underdiagnosed and undertreated for patients globally. We remain convinced in the tremendous opportunity to drive success in the future through our focus, innovation and leadership," said Zovighian.

About Edwards Lifesciences

Edwards Lifesciences is the global leader of patient-focused innovations for structural heart disease and critical care monitoring. We are driven by a passion for patients, dedicated to improving and enhancing lives through partnerships with clinicians and stakeholders across the global healthcare landscape. For more information, visit Edwards.com and follow us on Facebook, Instagram, LinkedIn, Twitter and YouTube.

Conference Call and Webcast Information

Edwards Lifesciences will be hosting a conference call today at 2:00 p.m. PT to discuss its third quarter results. To participate in the conference call, dial (877) 704-2848 or (201) 389-0893. The call will also be available live and archived on the "Investor Relations" section of the Edwards web site at ir.edwards.com or www.edwards.com.

This news release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements can sometimes be identified by the use of words such as "may," "will," "should," "anticipate," "believe," "plan," "project," "estimate," "forecast," "potential," "predict," "early clinician feedback," "expect," "intend," "guidance," "outlook," "optimistic," "aspire," "confident" or other forms of these words or similar expressions and include, but are not limited to, statements made by Mr. Zovighian, fourth quarter and full year 2023 financial guidance, statements regarding the international adoption of TAVR, statements regarding transforming patient treatment, approvals, clinical outcomes, adoption, and the information in the Outlook section. No inferences or assumptions should be made from statements of past performance, efforts, or results which may not be indicative of future performance or results. Forward-looking statements are based on estimates and assumptions made by management of the company and are believed to be reasonable, though they are inherently uncertain, difficult to predict, and may be outside of the company's control. The company's forward-looking statements speak only as of the date on which they are made and the company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of the statement. If the company does update or correct one or more of these statements, investors and others should not conclude that the company will make additional updates or corrections.

Forward-looking statements involve risks and uncertainties that could cause actual results or experience to differ materially from that expressed or implied by the forward-looking statements. Factors that could cause actual results or experience to differ materially from that expressed or implied by the forward-looking statements include risk and uncertainties associated with the COVID pandemic, clinical trial or commercial results or new product approvals and therapy adoption; unpredictability of product launches; competitive dynamics; changes to reimbursement for the company's products; the company's success in developing new products and avoiding manufacturing supply and quality issues; the impact of currency exchange rates; the timing or results of R&D and clinical trials; unanticipated actions by the U.S. Food and Drug Administration and other regulatory agencies; unexpected litigation impacts or expenses; and other risks detailed in the company's filings with the Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K for the year ended December 31, 2022, and its other filings with the SEC. These filings, along with important safety information about our products, may be found at edwards.com.

Edwards, Edwards Lifesciences, the stylized E logo, Acumen, Acumen IQ, ENCIRCLE, EVOQUE, Hypotension Prediction Index, MITRIS, MITRIS RESILIA, PASCAL, PASCAL Precision, RESILIA, SAPIEN, SAPIEN M3, SAPIEN 3, SAPIEN 3 Ultra, and SAPIEN 3 Ultra RESILIA are trademarks of Edwards Lifesciences Corporation or its affiliates. All other trademarks are the property of their respective owners.

| ___________________ | |

| [1] | "Adjusted" amounts are non-GAAP items. "Underlying" and "constant currency" growth rates in this press release exclude foreign exchange fluctuations. Adjusted earnings per share is a non-GAAP item computed on a diluted basis and in this press release also excludes an intellectual property agreement and litigation expenses, amortization of intangible assets, fair value adjustments to contingent consideration liabilities arising from acquisitions, a significant program discontinuation, and the impact from tax law change. See "Non-GAAP Financial Information" and reconciliation tables below. |

| EDWARDS LIFESCIENCES CORPORATION | |||||||

| | |||||||

| | Three Months Ended | | Nine Months Ended | ||||

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ 1,480.9 | | $ 1,319.0 | | $ 4,470.7 | | $ 4,034.1 |

| Cost of sales | 350.4 | | 253.8 | | 1,022.9 | | 822.5 |

| | | | | | | | |

| Gross profit | 1,130.5 | | 1,065.2 | | 3,447.8 | | 3,211.6 |

| | | | | | | | |

| Selling, general, and administrative expenses | 439.6 | | 377.3 | | 1,344.6 | | 1,156.6 |

| Research and development expenses | 270.3 | | 233.6 | | 801.8 | | 713.0 |

| Intellectual property agreement and litigation expense (income), net | 2.2 | | (2.4) | | 193.6 | | 10.8 |

| Change in fair value of contingent consideration liabilities | — | | (12.5) | | (26.2) | | (36.3) |

| Special charge | — | | 66.8 | | — | | 66.8 |

| | | | | | | | |

| Operating income | 418.4 | | 402.4 | | 1,134.0 | | 1,300.7 |

| | | | | | | | |

| Interest income, net | (15.1) | | (6.9) | | (32.8) | | (8.4) |

| Other (income) expense, net | (5.8) | | 2.0 | | (9.6) | | 1.0 Werbung Mehr Nachrichten zur Edwards Lifesciences Corp Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. |