T. ROWE PRICE OHA SELECT PRIVATE CREDIT FUND ANNOUNCES DECEMBER 31, 2023 FINANCIAL RESULTS AND CLOSES PRIVATE PLACEMENT OF $300M 5-YEAR SENIOR UNSECURED NOTES

PR Newswire

NEW YORK, March 13, 2024

NEW YORK, March 13, 2024 /PRNewswire/ -- T. Rowe Price OHA Select Private Credit Fund (the "Company" or "OCREDIT") today announced financial results for the fourth quarter and year ended December 31, 2023, and the closing of a $300M Private Placement of 5-Year Senior Unsecured Notes.

"We are pleased with OCREDIT's performance and ramp to-date, having grown from $50 million in initial equity commitments to a billion-dollar-plus portfolio of high-quality investments," Eric Muller, OCREDIT's Chief Executive Officer said. "The Company's inaugural notes offering pursuant to a private placement marks a milestone in its capital management, and we look forward to continue to scale OCREDIT alongside the growing opportunity in senior private lending for the benefit of our shareholders."

QUARTERLY HIGHLIGHTS

- Net investment income (NII) per share was $1.03 with weighted average yield on debt and income producing investments, at amortized cost of 12.7%1;

- Earnings per share was $1.42 with inception-to-date2 annualized return of 15.96%3;

- Net unrealized appreciation on investments was $9.2 million;

- Net asset value per share as of December 31, 2023 was $28.00, up 1.9% from $27.49 as of September 30, 2023;

- Gross and net investment fundings were $228.9 million and $208.3 million, respectively;

- Ending debt-to-equity was 0.79x, as compared to 0.78x as of September 30, 2023;

- The Company had debt outstanding of $558.6 million with a weighted average cost of debt of 8.0%. During the fourth quarter, the Company had net borrowings of $175 million across their credit facilities;

- On March 7, 2024, the Company entered into a Master Note Purchase Agreement governing the issuance of $300.0 million in aggregate principal amount of Series 2024A Senior Notes, due March 7, 2029, with a fixed interest rate of 7.77% per year;

- During the fourth quarter, the Company issued 7,179,054 of Class I common shares for proceeds of $200.6 million. From January 1, 2024 through March 13, 2024, the Company received total proceeds of $125.1 million from common shareholders in connection with its public offering4.

DIVIDENDS

During the fourth quarter, the Company declared total distributions of $0.89 per share, of which $0.23 per share was a special distribution declared on December 27, 2023. As of December 31, 2023, the Company's annualized distribution yield (excluding special distributions) was 9.9%.5

From January 1, 2024 through March 13, 2024, the Company declared the following distributions:

| ($ per share) ARIVA.DE Börsen-GeflüsterWerbung Weiter aufwärts?

Morgan Stanley

Den Basisprospekt sowie die Endgültigen Bedingungen und die Basisinformationsblätter erhalten Sie hier: ME92Y1,. Beachten Sie auch die weiteren Hinweise zu dieser Werbung. Der Emittent ist berechtigt, Wertpapiere mit open end-Laufzeit zu kündigen.

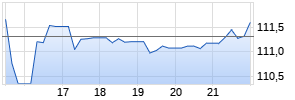

Kurse

| January 29, 2024 | February 27, 2024 | ||||||||||

| Base Distribution | $0.20 | $0.20 | ||||||||||

| Variable Distribution | $0.03 | $0.03 | ||||||||||

| Total Distribution | $0.23 | $0.23 | ||||||||||

SELECTED FINANCIAL HIGHLIGHTS

| ($ in millions, unless otherwise noted) | Q4 2023 | Q3 2023 | |

| Net investment income per share | $1.03 | $1.02 | |

| Net investment income | $21,038 | $12,292 | |

| Earnings per share | $1.42 | $1.67 | |

| | | | |

| ($ in millions, unless otherwise noted) | As of December 31, 2023 | As of September 30, 2023 | |

| Total fair value of investments | $1,148.4 | $929.6 | |

| Total assets | $1,286.1 | $1,096.2 | |

| Total net assets | $704.4 | $494.2 | |

| Net asset value per share | $28.00 | $27.49 | |

| | | | |

INVESTMENT ACTIVITY

For three months ended December 31, 2023, net investment fundings were $208.3 million. The Company invested $228.9 million during the quarter, including $147.6 million in 7 new companies and $81.3 million in existing companies. The Company had $20.6 million of principal repayments and sales during the quarter.

| ($ in millions, unless otherwise noted) | Q4 2023 | Q3 2023 |

| Investment Fundings | $228.9 | $334.2 |

| Sales and Repayments | $20.6 | $12.8 |

| Net Investment Activity | $208.3 | $322.5 |

As of December 31, 2023, the Company's investment portfolio had a fair value of $1,148.4 million, comprised of investments in 90 portfolio companies operating across 22 different industries. The investment portfolio at fair value was comprised of 90.8% first lien senior secured loans and 9.2% second lien senior secured loans. In addition, as of December 31, 2023, 100% of the Company's debt investments based on fair value were at floating rates, and there were no investments on non-accrual status.

ABOUT T. ROWE PRICE OHA SELECT PRIVATE CREDIT FUND

T. Rowe Price OHA Select Private Credit Fund (the "Company" or "OCREDIT") is a non-diversified, closed-end management investment company that has elected to be regulated as a business development company ("BDC") under the Investment Company Act of 1940, as amended (the "1940 Act"). The Company has also elected to be treated as a regulated investment company ("RIC") under the Internal Revenue Code of 1986, as amended (the "Code"). OHA Private Credit Advisors LLC (the "Adviser") is the investment adviser of the Company. The Adviser is registered as an investment adviser with the U.S. Securities and Exchange Commission (the "SEC") under the Investment Advisers Act of 1940. OCREDIT's registration statement became effective on September 29, 2023. From inception through December 31, 2023, the Company has invested approximately $1,172.3 million in aggregate cost of debt investments prior to any subsequent exits or repayments. The Company's investment objective is to generate attractive risk-adjusted returns, predominately in the form of current income, with select investments capturing long-term capital appreciation, while maintaining a strong focus on downside protection. OCREDIT invests primarily in directly originated and customized private financing solutions, including loans and other debt securities with a strong focus on senior secured lending to larger companies.

Please visit www.ocreditfund.com for additional information.

FORWARD-LOOKING STATEMENTS

Certain information contained in this communication constitutes "forward-looking statements" within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology, such as "outlook," "indicator," "believes," "expects," "potential," "continues," "may," "can," "will," "should," "seeks," "approximately," "predicts," "intends," "plans," "estimates," "anticipates", "confident," "conviction," "identified" or the negative versions of these words or other comparable words thereof. These may include financial projections and estimates and their underlying assumptions, statements about plans, objectives, and expectations with respect to future operations, statements regarding future performance, statements regarding economic and market trends and statements regarding identified but not yet closed investments. Such forward-looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. OCREDIT believes these factors also include but are not limited to those described under the section entitled "Risk Factors" in its prospectus, and any such updated factors included in its periodic filings with the Securities and Exchange Commission (the "SEC"), which are accessible on the SEC's website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document (or OCREDIT's prospectus and other filings). Except as otherwise required by federal securities laws, OCREDIT undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

ABOUT OAK HILL ADVISORS

Oak Hill Advisors (OHA) is a leading global credit-focused alternative asset manager with over 30 years of investment experience. OHA works with institutions and individuals and seeks to deliver a consistent track record of risk-adjusted returns with downside focus. The firm manages approximately $63 billion of capital across credit strategies, including private credit, high yield bonds, leveraged loans, stressed and distressed debt and collateralized loan obligations as of December 31, 2023. OHA's emphasis on long-term partnerships with companies, sponsors and other partners provides access to a proprietary opportunity set allowing for customized credit solutions with strength across market cycles.

With over 420 experienced professionals across six global offices, OHA brings a collaborative approach to offering investors a single platform to meet their diverse credit needs. OHA is the private markets platform of T. Rowe Price Group, Inc. (NASDAQ – GS: TROW). For more information, please visit oakhilladvisors.com.

ABOUT T. ROWE PRICE

Founded in 1937, T. Rowe Price (NASDAQ – GS: TROW) helps individuals and institutions around the world achieve their long-term investment goals. As a large global asset management company known for investment excellence, retirement leadership, and independent proprietary research, the firm is built on a culture of integrity that puts client interests first. Clients rely on the award-winning firm for its retirement expertise and active management of equity, fixed income, alternatives, and multi-asset investment capabilities. T. Rowe Price has $1.51 trillion in assets under management as of February 29, 2024, and serves millions of clients globally. News and other updates can be found on Facebook, Instagram, LinkedIn, X, YouTube, and troweprice.com/newsroom.

| T. Rowe Price OHA Select Private Credit Fund Consolidated Statements of Assets and Liabilities (in thousands, except per share amounts) | ||

| | ||

| | As of | |

| | December 31, 2023 | December 31, 2022 |

| Assets | | |

| Investments at fair value: | | |

| Non-controlled/non-affiliated investments (cost of $1,131,726 and | $ 1,148,412 | $ 71,758 |

| Cash, cash equivalents and restricted cash | 105,456 | 19,486 |

| Interest receivable for non-controlled/non-affiliated investments | 15,498 | 356 |

| Deferred financing costs | 6,021 | 335 |

| Deferred offering costs Werbung Mehr Nachrichten zur T. Rowe Price Group Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||