Im folgenden Artikel liefert Chandler Argumente, warum er (wie schon seit langem) Dollar-bärisch ist. Er lag mit seinem Hedgefond in der Vergangenheit allerdings oft falsch: Beim USD/JPY-Kurs von 110 war er long Yen (ein Verlusttrade, heute 114), bei EUR/CHF = 1,55 war er long Schweizer Franken (ebenfalls ein Verlusttrade, heute 1,57). Trotzdem sind seine Argumente interessant und sicherlich lesenswert.

Ich selber rechne damit, dass die Fed am 8. August eine Pause macht. Dies dürfte den Dollar nach der EZB-Erhöhung auf 3 % (letzten Donnerstag) temporär schwächen. Langfristig dürfte jedoch der absolute Zinsvorteil den Ausschlag geben.

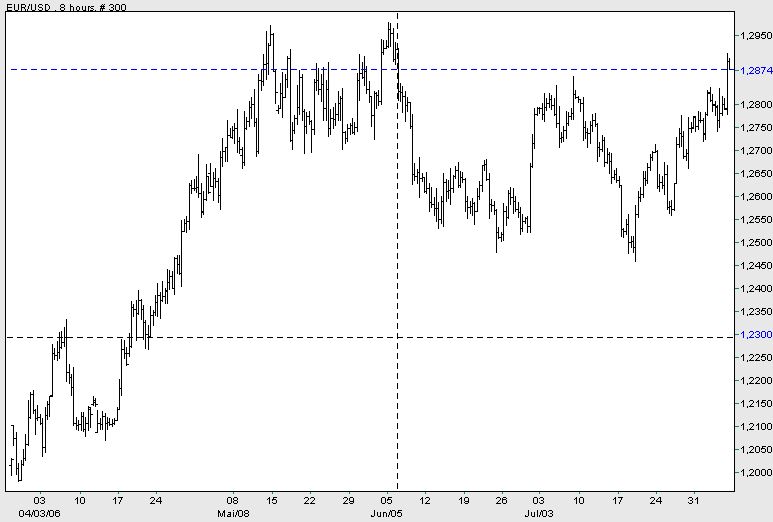

Ich habe eine offene Kauforder zu 1,2970 Dollar (gegen Euro). Das ist der Kurs der letzten Hochs im Mai und Juni. Die Order basiert auf der Erwartung eines "Tripel-Tops" bei 1,2970 (siehe Chart unten). McKegg von www.Forexnews.com sieht beim Euro hingegen eine fünfte Aufwärtswelle, die bis 1,3150 geht (siehe unter diesem Link). Wäre dem so, würde ich bei 1,3150 nachkaufen.

P.S. Bin bis nächsten Donnerstag in Urlaub an der Ostsee (ohne Computer) und werde daher zum Fed-Entscheid am 8. August vorerst nichts posten.

Currencies

Don't Expect Fed to Put on Its Turn Signal

By Marc Chandler

Street.com Contributor

8/4/2006 4:04 PM EDT

The weaker-than-expected U.S. July employment report is likely to deliver the coup de grace to the uninterrupted run of rate hikes by the Federal Reserve that began two summers ago. Over the past couple of weeks, expectations of an August rate hike have been scaled back. But many, including me, thought that with price pressures still accelerating according to some measures and expectations still at elevated levels, the dovish Bernanke Fed would want to ensure that price pressures wouldn't build and want to brandish its anti-inflation credentials.

Fed officials aren't married to any one piece of economic data. Nevertheless, the weaker-than-expected employment report, following on the heels of other reports that warn that the pace of economic activity may slipping below trend, has seen a firming of expectations that the Fed will stand pat when the FOMC meets next week. The August fed funds futures contract is pricing in less than a 1 in 6 chance of a hike. Given the accuracy of nearby fed funds futures contracts in predicting Fed moves, this is an important development.

Turning Off the Blinker

But take the fact that the fed funds futures strip has taken the increasingly probable pause in August to be the end of the tightening cycle with a grain of salt. The Fed will seek to counter this notion in the statement that accompanies its decision on Tuesday. Few past cycles were characterized by consecutive rate hikes, and none have gone on as long as this campaign. Past monetary cycles often featured moves and pauses.

There are several reasons it behooves the Fed to refrain from signaling an end to the tightening cycle. First, as the Fed pauses, it doesn't want to say anything that would risk diminishing its commitment to price stability. Second, refraining from "end talk" is consistent with efforts to introduce or increase the flexibility of monetary policy. Shifting from a 25-basis-point rate hike at every meeting to a stand-pat stance at every meeting simply replaces one rigidity with another.

But perhaps the most important reason the Fed is likely to keep the door more ajar than the market appreciates is that the critical issue is unresolved. That critical issue is whether the moderation of U.S. growth is sustainable and sufficient to bring price pressures and expectations back to more acceptable levels.

The pace of U.S. economic activity has clearly slowed. One way to illustrate this is to consider U.S. GDP relative to the 20-quarter moving average. With the exception of the hurricane-distorted fourth quarter of 2005, the annualized pace of U.S. quarterly growth has remained above this moving average since the second quarter of 2003. The first estimate of 2.5% in the second quarter puts it below the 20-quarter average of 2.8%. While the pullback by the household sector is well appreciated, the expected offsets, like business investment, were weaker than anticipated, and inventory rebuilding is thought to "borrow" activity from the third quarter.

However, the risk is that once again, the demise of the American consumer has been exaggerated. The confidence numbers have held up and early chain-store sales for July were also generally better than expected. Could it be that the American household has made the adjustment to the increase in gasoline prices and went shopping again? Could it be that with 10- and 30-year Treasury yields below 5%, people feel more confident that home prices aren't about to collapse? With the U.S. 10-year yield now at its lowest level since late March, the Federal Reserve can't afford to risk the market unwinding its hard work and reinvigorating the economy.

If the Fed does pause, as is now the odds-on favorite scenario, under what conditions would it resume raising rates? Fed officials appear to believe that as economic growth slows, upward pressure will be removed from prices, and inflation and inflation expectations will also ease. So renewed vibrant growth led by household consumption would probably get the Fed to tap the monetary brakes again.

There were periods under Alan Greenspan's tenure when the Fed seemed to question this tradeoff between growth and inflation. Economists call this tradeoff -- or more precisely, the tradeoff between unemployment and inflation -- the Philips curve. The Bernanke Fed (not just the chairman) is relatively new and does not (yet) enjoy the same confidence among the investor class that Greenspan won over the years. It's not a total lack of confidence (this spring's confidence crisis was grossly exaggerated), but that the confidence level in this new Fed isn't as high translates, operationally, into fewer degrees of freedom.

Precarious Spot for the Greenback

Unfortunately, the Bernanke Fed can't afford to push the envelope with a growth experiment the way Greenspan could. The Philips curve remains center stage. This is far different from the more monetarist approach that seemed to dominate previously and which still appears to hold sway in Europe and Japan. Perhaps this was best symbolized by the Fed's decision earlier this year to stop publishing the money supply measure, M3.

There are many indications that the world remains awash in liquidity, not including the more than six-week decline in U.S. bond yields. Contrary to conventional wisdom, the draining of the excess reserves in Japan and the Bank of Japan's quarter-point rate hike did not end the yen-carry trades. The Commitment of Traders data from the IMM currencies futures is clear on this: Non-commercial accounts (speculators) had a record short-yen position at the end of July, with a sharp rise after the rate hike. Japan's weekly portfolio flows showed a net outflow consistently in the run-up to the rate-hike decision and the two weeks that followed it.

The Swiss franc, which offers the second-lowest interest rate next to Japan, also has underperformed recently. That underperformance is all the more notable because of the apparent loss of its safe-haven statues.

Not only did low-yielding instruments do poorly, but higher-yielding instruments did better. The Australian dollar and New Zealand dollar, among the higher-yielding liquid currencies, have returned to favor. Most noteworthy, though, has been the return of capital to the emerging markets. The Emerging Portfolio Fund Research reports that funds devoted to Brazil, Russia, India and China actually have experienced net inflows over the past five weeks. Funds devoted to investment in Latin America also recorded net inflows. On the other hand, funds that invest in Turkey, Hungary and South Africa are still experiencing net outflows.

The return of capital to emerging markets is also evident in the fixed-income market. The spread of a basket of emerging-market bonds measured by JPMorgan's EMBI+ index over U.S. Treasuries has fallen from almost 240 bp at the late-June peak to about 190 bp today.

These conditions leave the U.S. dollar particularly vulnerable. Even if the Fed keeps the policy door ajar, the risk is the market looks past it, toward the risk of additional rate hikes in Europe, Japan and probably in many emerging economies, including China and India. This is likely to keep the dollar broadly under pressure.

The Outlook for Major Currencies

Pullbacks in the euro should be limited to the $1.2840 area. Option barriers and psychological considerations will make the $1.2950-$1.3000 band formidable resistance in the days ahead. The dollar's losses against the yen after the jobs data and after trading above JPY115.50 earlier in Friday's session warn of the risk of steep losses in the week ahead. The failure of support near JPY113.80 could signal the beginning of the move.

One way in which some U.S. investors, even those who invest strictly in U.S. companies, could take advantage of the heightened currency risk of the U.S. dollar would be to buy an ETF linked to the performance of a single currency. The first, launched at the end of last year by Rydex, is for the euro, Euro Currency Trust (FXE) . Rydex has also launched ETFs tied to a handful of other currencies.

The British pound was the strongest of the major currencies over the past week, owing in no small measure to the surprise 25-bp rate hike from the Bank of England. It rose about 2.5% against the U.S. dollar to reach its highest level since April 2005. In addition to its speculative demand, sterling, even more than the euro, appears to be a key beneficiary of the diversification of reserves away from both the yen and to some extent, the U.S. dollar.

Sterling is establishing a foothold above the $1.90 market. In the coming weeks, the market will set its sights on the $1.92-$1.95 area. When approached, this will offer longer-term "value" players a golden opportunity to sell it.

At time of publication, Chandler had no positions in the stocks mentioned. (Verkleinert auf 72%)