Technology group Wärtsilä, in partnership with Chevron Shipping Company LLC, plans to convert one engine on six of Chevron Transport Corporation Ltd.’s LNG Carriers from dual-fuel (DF) to spark gas (SG) operation. The conversions are intended to reduce greenhouse gas emissions by lowering methane slip in support of Chevron Shipping’s broader efforts to reduce the carbon intensity of its operations. This marine industry first was made possible after two years of collaboration between the companies. The order for the first two vessels was booked by Wärtsilä in Q3 2024.

LNG, when burned as a fuel, results in small amounts of methane that may not fully combust leading to methane escaping into the atmosphere, referred to as methane slip. Methane exists in the atmosphere for a shorter time than CO₂ but traps approximately 25–30* times more heat over a 100-year period. Addressing methane emissions is a key part of lowering carbon intensity. Wärtsilä’s 50DF to SG conversion project is designed to modify the engines in service to operate as SG, using spark ignition versus diesel pilot fuel to initiate combustion. This enables a more optimised combustion process, thereby reducing the methane slip and improving efficiency.

“Chevron Shipping aims to reduce methane emissions intensity of our LNG fleet in support of a lower carbon future,” says Barbara Pickering, president of Chevron Shipping. “We are pleased to collaborate with Wärtsilä in this industry first. This demonstrates steps we are taking to help reduce the carbon intensity of marine transportation."

“This innovative project represents a notable step forward on the road to advancing lower carbon fleets,” comments Roger Holm, president of Wärtsilä Marine & executive vice president at Wärtsilä Corporation. “Wärtsilä has an extensive track-record in reducing methane slip from LNG-fuelled engines, not only as newbuild solutions, but also through retrofitting existing installations.”

This new technology complements Wärtsilä's extensive portfolio of solutions aimed at reducing methane emissions from vessels. With nearly three decades of experience in LNG technology, Wärtsilä is providing market leading performance both with the dual fuel flexibility provided by the DF engine, as well as with the single fuel SG engine.

About Chevron:

Chevron is one of the world’s leading integrated energy companies. We believe affordable, reliable and ever cleaner energy is essential to enabling human progress. Chevron produces crude oil and natural gas; manufactures transportation fuels, lubricants, petrochemicals and additives; and develops technologies that enhance our business and the industry. We aim to grow our oil and gas business, lower the carbon intensity of our operations and grow lower carbon businesses in renewable fuels, carbon capture and offsets, hydrogen and other emerging technologies. More information about Chevron is available at www.chevron.com.

About Wärtsilä:

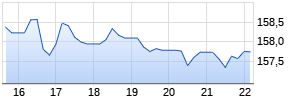

Wärtsilä is a global leader in innovative technologies and lifecycle solutions for the marine and energy markets. We emphasise innovation in sustainable technology and services to help our customers continuously improve environmental and economic performance. Our dedicated and passionate team of 17,800 professionals in more than 280 locations in 79 countries shape the decarbonisation transformation of our industries across the globe. In 2023, Wärtsilä’s net sales totalled EUR 6.0 billion. Wärtsilä is listed on Nasdaq Helsinki.

www.wartsila.com

About Wärtsilä Marine:

Wärtsilä Marine is a global pioneer in power, propulsion, and lifecycle solutions for the marine market. We develop industry-leading technologies, advancing maritime's transition to new fuels. We support building an end-to-end digital ecosystem where all vessels and ports are connected. Ultimately, Wärtsilä Marine is driving the shipping industry forward on its journey towards a decarbonised and sustainable future through our broad portfolio of engines, propulsion systems, hybrid technology, exhaust treatment, shaft line solutions and digital technologies, as well as integrated powertrain systems. Our offering, which is underpinned by our performance-based agreements, upgrades, lifecycle solutions, decarbonisation services, as well as an unrivalled global network of maritime expertise, delivers the efficiency, reliability, safety, and environmental performance needed to support a safe and sustainable future for our customers, our communities, and our planet.

www.wartsila.com/marine

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements relating to Chevron’s operations and lower carbon strategy that are based on management’s current expectations, estimates, and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “advances,” “commits,” “drives,” “aims,” “forecasts,” “projects,” “believes,” “approaches,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,” “progress,” “may,” “can,” “could,” “should,” “will,” “budgets,” “outlook,” “trends,” “guidance,” “focus,” “on track,” “goals,” “objectives,” “strategies,” “opportunities,” “poised,” “potential,” “ambitions,” “aspires” and similar expressions, and variations or negatives of these words, are intended to identify such forward-looking statements, but not all forward-looking statements include such words. These statements are not guarantees of future performance and are subject to numerous risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this news release. Unless legally required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changing crude oil and natural gas prices and demand for the company’s products, and production curtailments due to market conditions; crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries and other producing countries; technological advancements; changes to government policies in the countries in which the company operates; public health crises, such as pandemics and epidemics, and any related government policies and actions; disruptions in the company’s global supply chain, including supply chain constraints and escalation of the cost of goods and services; changing economic, regulatory and political environments in the various countries in which the company operates; general domestic and international economic, market and political conditions, including the military conflict between Russia and Ukraine, the conflict in Israel and the global response to these hostilities; changing refining, marketing and chemicals margins; actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy sources or product substitutes; development of large carbon capture and offset markets; the results of operations and financial condition of the company’s suppliers, vendors, partners and equity affiliates; the inability or failure of the company’s joint-venture partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption or interruption of the company’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats, terrorist acts, or other natural or human causes beyond the company’s control; the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant operational, investment or product changes undertaken or required by existing or future environmental statutes and regulations, including international agreements and national or regional legislation and regulatory measures related to greenhouse gas emissions and climate change; the potential liability resulting from pending or future litigation; the risk that regulatory approvals with respect to the Hess Corporation (Hess) transaction are not obtained or are obtained subject to conditions that are not anticipated by the company and Hess; potential delays in consummating the Hess transaction, including as a result of regulatory proceedings or the ongoing arbitration proceedings regarding preemptive rights in the Stabroek Block joint operating agreement; risks that such ongoing arbitration is not satisfactorily resolved and the potential transaction fails to be consummated; uncertainties as to whether the potential transaction, if consummated, will achieve its anticipated economic benefits, including as a result of regulatory proceedings and risks associated with third party contracts containing material consent, anti-assignment, transfer or other provisions that may be related to the potential transaction that are not waived or otherwise satisfactorily resolved; the company’s ability to integrate Hess’ operations in a successful manner and in the expected time period; the possibility that any of the anticipated benefits and projected synergies of the potential transaction will not be realized or will not be realized within the expected time period; the company’s future acquisitions or dispositions of assets or shares or the delay or failure of such transactions to close based on required closing conditions; the potential for gains and losses from asset dispositions or impairments; government mandated sales, divestitures, recapitalizations, taxes and tax audits, tariffs, sanctions, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar; higher inflation and related impacts; material reductions in corporate liquidity and access to debt markets; changes to the company’s capital allocation strategies; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; the company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry; and the factors set forth under the heading “Risk Factors” on pages 20 through 26 of the company’s 2023 Annual Report on Form 10-K and in subsequent filings with the U.S. Securities and Exchange Commission. Other unpredictable or unknown factors not discussed in this news release could also have material adverse effects on forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240919965550/en/