LendingClub Reports Third Quarter 2024 Results

PR Newswire

SAN FRANCISCO, Oct. 23, 2024

Originations and Revenue Growth Supported by Return of Bank Buyers

Total Assets Grew 25% Year to Date Driven by $1.3 Billion Purchase of LendingClub Loans

Acquired Tally's Technology in October to Accelerate Product Roadmap

SAN FRANCISCO, Oct. 23, 2024 /PRNewswire/ -- LendingClub Corporation (NYSE: LC), the parent company of LendingClub Bank, America's leading digital marketplace bank, today announced financial results for the third quarter ended September 30, 2024.

"We had a standout quarter, with credit outperformance and the return of bank buyers driving improved loan sales pricing, our capital strategy delivering a 25% larger balance sheet year to date, and strong financial performance translating to a meaningful improvement in book value per common share over the past 12 months," said Scott Sanborn, LendingClub CEO. "Looking ahead, our acquisition of Tally's award-winning credit card debt monitoring and management technology will allow us to accelerate our product roadmap and further seize on the historically large $1.3 trillion credit card refinance opportunity."

Third Quarter 2024 Results

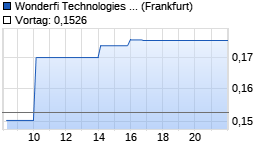

Aktie im Fokus

|

Wonderfi Technologies Inc.

0,1758

€

+15,2%  |

Kurse

|

Balance Sheet:

- Total assets of $11.0 billion compared to $9.6 billion in the prior quarter, primarily due to growth in whole loans held on the balance sheet and securities related to the structured certificates program:

- Whole loans held on the balance sheet of $6.0 billion, compared to $5.1 billion in the prior quarter, primarily reflecting the purchase of a $1.3 billion LendingClub-issued loan portfolio.

- Securities available for sale of $3.3 billion, compared to $2.8 billion in the prior quarter, primarily reflecting growth in structured certificate securities.

- Deposits of $9.5 billion compared to $8.1 billion in the prior quarter, primarily due to an increase in consumer deposits and brokered certificates of deposit to fund the loan portfolio purchase.

- Launched new direct-to-consumer LevelUp Savings product and seeing positive consumer response.

- 88% of total deposits are FDIC-insured.

- Strong liquidity profile with $3.6 billion in readily available liquidity.

- Strong capital position with a consolidated Tier 1 leverage ratio of 11.3% and consolidated Common Equity Tier 1 capital ratio of 15.9%.

- Book value per common share increased to $11.95, compared to $11.52 in the prior quarter.

- Tangible book value per common share increased to $11.19, compared to $10.75 in the prior quarter.

Financial Performance:

- Loan originations grew to $1.9 billion, compared to $1.8 billion in the prior quarter, driven by the successful execution of new consumer loan initiatives, combined with marketplace investor demand for structured certificates and higher whole loan retention.

- Total net revenue increased to $201.9 million, compared to $187.2 million in the prior quarter, driven by higher net interest income from a larger balance sheet and improved marketplace loan sales pricing.

- Provision for credit losses of $47.5 million, compared to $35.6 million in the prior quarter, driven by higher held-for-investment whole loan retention during the quarter.

- Decline in net charge-offs in the held-for-investment at amortized cost loan portfolio to $55.8 million, down from $66.8 million in the prior quarter; net charge-off ratio of 5.4% compared to 6.2% in the prior quarter.

- Net income was $14.5 million, compared to $14.9 million in the prior quarter, with diluted EPS of $0.13 in both periods.

- Pre-Provision Net Revenue (PPNR) increased to $65.5 million, compared to $55.0 million in the prior quarter, driven by a $14.7 million increase in total net revenue partially offset by a $4.0 million increase in non-interest expense.

| | Three Months Ended | | ||||

| ($ in millions, except per share amounts) | September 30, | | June 30, | | September 30, | |

| Total net revenue | $ 201.9 | | $ 187.2 | | $ 200.8 | |

| Non-interest expense | 136.3 | | 132.3 | | 128.0 | |

| Pre-provision net revenue (1) | 65.5 | | 55.0 | | 72.8 | |

| Provision for credit losses | 47.5 | | 35.6 | | 64.5 | |

| Income before income tax expense | 18.0 | | 19.4 | | 8.3 | |

| Income tax expense | (3.6) | | (4.5) | | (3.3) | |

| Net income | $ 14.5 | | $ 14.9 | | $ 5.0 | |

| Diluted EPS | $ 0.13 | | $ 0.13 | | $ 0.05 | |

| | |

| (1) | See page 3 of this release for additional information on our use of non-GAAP financial measures. |

For a calculation of Pre-Provision Net Revenue and Tangible Book Value Per Common Share, refer to the "Reconciliation of GAAP to Non-GAAP Financial Measures" tables at the end of this release.

Financial Outlook

| | Fourth Quarter 2024 | |

| Loan originations | $1.8B to $1.9B | |

| Pre-provision net revenue (PPNR) | $60M to $70M |

About LendingClub

LendingClub Corporation (NYSE: LC) is the parent company of LendingClub Bank, National Association, Member FDIC. LendingClub Bank is the leading digital marketplace bank in the U.S., where members can access a broad range of financial products and services designed to help them pay less when borrowing and earn more when saving. Based on hundreds of billions of cells of data and over $90 billion in loans, our advanced credit decisioning and machine-learning models are used across the customer lifecycle to expand seamless access to credit for our members, while generating compelling risk-adjusted returns for our loan investors. Since 2007, more than 5 million members have joined the Club to help reach their financial goals. For more information about LendingClub, visit https://www.lendingclub.com.

Conference Call and Webcast Information

The LendingClub third quarter 2024 webcast and teleconference is scheduled to begin at 2:00 p.m. Pacific Time (or 5:00 p.m. Eastern Time) on Wednesday, October 23, 2024. A live webcast of the call will be available at http://ir.lendingclub.com under the Filings & Financials menu in Quarterly Results. To access the call, please dial +1 (404) 975-4839, or outside the U.S. +1 (833) 470-1428, with Access Code 834946, ten minutes prior to 2:00 p.m. Pacific Time (or 5:00 p.m. Eastern Time). An audio archive of the call will be available at http://ir.lendingclub.com. An audio replay will also be available 1 hour after the end of the call until October 30, 2024, by calling +1 (929) 458-6194 or outside the U.S. +1 (866) 813-9403, with Access Code 106763. LendingClub has used, and intends to use, its investor relations website, blog (http://blog.lendingclub.com), X (formerly Twitter) handles (@LendingClub and @LendingClubIR) and Facebook page (https://www.facebook.com/LendingClubTeam) as a means of disclosing material non-public information and to comply with its disclosure obligations under Regulation FD.

Contacts

For Investors:

IR@lendingclub.com

Media Contact:

Press@lendingclub.com

Non-GAAP Financial Measures

To supplement our financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: Pre-Provision Net Revenue and Tangible Book Value Per Common Share. Our non-GAAP financial measures do have limitations as analytical tools and you should not consider them in isolation or as a substitute for an analysis of our results under GAAP.

We believe these non-GAAP financial measures provide management and investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and enable comparison of our financial results with other public companies.

We believe Pre-Provision Net Revenue is an important measure because it reflects the financial performance of our business operations. Pre-Provision Net Revenue is a non-GAAP financial measure calculated by subtracting the provision for credit losses and income tax benefit/expense from net income.

We believe Tangible Book Value (TBV) Per Common Share is an important measure used to evaluate the company's use of equity. TBV Per Common Share is a non-GAAP financial measure representing common equity reduced by goodwill and intangible assets, divided by ending common shares issued and outstanding.

For a reconciliation of such measures to the nearest GAAP measures, please refer to the tables on page 13 of this release.

We do not provide a reconciliation of forward-looking Pre-Provision Net Revenue to the most directly comparable GAAP reported financial measures on a forward-looking basis because we are unable to predict future provision expense with reasonable certainty without unreasonable effort.

Safe Harbor Statement

Some of the statements above, including statements regarding our competitive advantages, macroeconomic outlook, anticipated future performance and financial results, are "forward-looking statements." The words "anticipate," "believe," "estimate," "expect," "intend," "may," "outlook," "plan," "predict," "project," "will," "would" and similar expressions may identify forward-looking statements, although not all forward-looking statements contain these identifying words. Factors that could cause actual results to differ materially from those contemplated by these forward-looking statements include: our ability to continue to attract and retain new and existing borrowers and platform investors; competition; overall economic conditions; the interest rate environment; the regulatory environment; default rates and those factors set forth in the section titled "Risk Factors" in our most recent Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, as well as in our subsequent filings with the Securities and Exchange Commission. We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in forward-looking statements. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| LENDINGCLUB CORPORATION OPERATING HIGHLIGHTS (In thousands, except percentages or as noted) (Unaudited) | | |||||||||||||

| | ||||||||||||||

| | As of and for the three months ended | | % Change | |||||||||||

| | September 30, | | June 30, | | March 31, 2024 | | December 31, 2023 | | September 30, | | Q/Q | | Y/Y | |

| Operating Highlights: | ||||||||||||||

| Non-interest income | $ 61,640 | | $ 58,713 | | $ 57,800 | | $ 54,129 | | $ 63,844 | | 5 % | | (3) % | |

| Net interest income | 140,241 Werbung Mehr Nachrichten zur LendingClub Corp Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||||||