Oscilar Unveils Groundbreaking AI-Powered AML Risk Platform, Transforming Compliance for Fintechs, Sponsor Banks, and Financial Ecosystem

PR Newswire

MENLO PARK, Calif., April 8, 2024

Introducing Applied Machine Learning, generative AI, and Analytical Capabilities for Real-Time Oversight and Enhanced AML Operations in Fintech and Banking

MENLO PARK, Calif., April 8, 2024 /PRNewswire/ -- Oscilar, a leading force in AI-Powered financial risk management, today publicly unveiled an industry-leading AI-Powered AML Risk Platform at the ACAMS Summit in Florida. This innovation represents a major leap forward in Anti-Money Laundering (AML) operations by equipping sponsor banks, fintechs, and financial institutions with unparalleled real-time monitoring, meticulous reporting, and in-tool backtesting and validation capabilities.

The complexity of AML programs places a heavy burden on financial institutions navigating a maze of global risks, with money laundering estimated to be 2-5% of global GDP, amounting to up to $2 trillion annually, according to the United Nations. Facing increasing regulatory scrutiny, Banking-as-a-Service (BaaS) programs require innovative Anti-Money Laundering (AML) solutions that reconcile the stringent compliance demands of traditional banking with the fast-paced innovation of fintech.

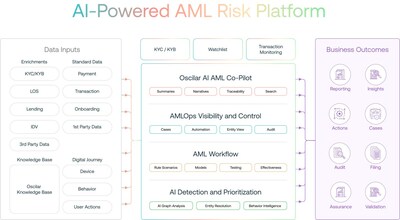

Oscilar's unified AI-Powered AML Risk Platform monitors AML and Fraud risks, employing foundational AML rules with generative AI (Gen AI) and Machine Learning models for real-time detection, investigation, and enhanced collaboration between sponsor banks and fintechs. The platform revolutionizes AML operations with Oscilar AI, a Gen AI AML Co-Pilot, advanced AML Ops Visibility and Control, and AI tools like anomaly detection models. Oscilar's No-code and Natural Language AML Scenario Testing and Auditing capabilities empower specialists to efficiently develop, test, and audit tailored AML strategies that meet regulatory standards and unique risks.

Oscilar's AI-Powered AML Risk Platform is already being used by a number of fintechs, financial institutions, and sponsor banks for customer onboarding, transaction monitoring, compliance visibility, and regulatory reporting needs.

"Oscilar's expanded AML Risk platform capabilities, such as the GenAI Co-Pilot and Mission Control Dashboard, have the potential to be a game-changer for compliance operations. These innovations promise insights and oversight that were previously unimaginable," shares Eric Wright, Chief Operating Officer at CC Bank.

Aktie im Fokus

|

SOL Global Investment Corp

0,274

€

+5,38%  |

Kurse

|

"By advancing our AML solution with these latest capabilities, we reinforce our commitment to enabling financial innovation while ensuring stringent compliance and security," states Neha Narkhede, Co-Founder and CEO of Oscilar. "Our goal is to empower our fintechs and financial institutions to navigate the regulatory landscape with ease and confidence."

Oscilar AI, A GenAI-Powered AML Co-Pilot: Assisting AML Investigations, Analytics & Compliance Explainability

Oscilar AI, Oscilar's AML Co-Pilot, provides real-time intelligence to AML teams, such as AI-generated case summaries, SAR narratives, and search recommendations, enabling AML teams to make decisions in minutes.

AMLOps Visibility and Control: Redefining Compliance Oversight

Oscilar's AML Risk Platform features a Mission Control Dashboard, providing both sponsor banks and fintechs with a comprehensive overview and thorough oversight of AML programs. The integrated Case Management experience connects alerts, investigations, reporting in real-time to give fintechs and sponsor banks a unified workspace to collaborate.

Applied AI for AML: Elevating Detection and Alert Efficiency with Auditable Models

Oscilar boosts AML teams' efficiency with AI models for Alert Prioritization, Link Analysis, and Suspicious Activity Monitoring. These models are supported by Human-In-The-Loop techniques and a Fairness and Governance Model, ensuring unbiased detection and full traceability.

Transparent AML Workflows and Scenario Testing: Streamlining Compliance

Oscilar's AML Risk Platform offers quick AML setup, flexible data integration, and a no-code interface. Utilizing generative AI for intuitive rule writing provides an adaptive AML compliance approach, enhancing efficiency and transparency for fintechs and banks.

"Oscilar is committed to help shape the future of AML compliance by harnessing the power of generative AI, collaborating with regulators, and leveraging applied Machine Learning and automation to uncover complex AML scenarios. Our mission is to bring increased speed, transparency, and efficiency to AML programs across the financial ecosystem while reducing operational costs and risk," states Neha Narkhede, Co-Founder and CEO of Oscilar.

Learn more about Oscilar's AI-Powered AML Risk Platform by visiting https://oscilar.com/blog/ai-powered-aml-risk-platform.

About Oscilar

Oscilar stands at the cutting edge of financial compliance and risk management technology, delivering AI-driven solutions that redefine how fintechs and sponsor banks achieve regulatory compliance, enhance security, and foster growth. With Oscilar, partners gain access to innovative tools and capabilities that streamline compliance processes, ensuring a secure and compliant path to financial innovation. Oscilar, which was co-founded in 2021 by Confluent (NASDAQ: CFLT) Co-founder Neha Narkhede, has seen explosive growth and is working with dozens of leading fintechs and financial customers.

CONTACT: press@oscilar.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/oscilar-unveils-groundbreaking-ai-powered-aml-risk-platform-transforming-compliance-for-fintechs-sponsor-banks-and-financial-ecosystem-302110349.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/oscilar-unveils-groundbreaking-ai-powered-aml-risk-platform-transforming-compliance-for-fintechs-sponsor-banks-and-financial-ecosystem-302110349.html

SOURCE Oscilar

Mehr Nachrichten zur Confluent Inc. Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.