Van Lanschot Kempen: third-quarter trading update 2023

Amsterdam/’s-Hertogenbosch, the Netherlands, 2 November 2023

- Third-quarter results in line with first two quarters of 2023

- Net AuM inflows at Private Clients ytd €2.7 billion, Q3 €0.5 billion

- Net AuM inflows at Wholesale & Institutional Clients ytd €0.9 billion, Q3 €0.1 billion negative

- Client assets: €133.6 billion (end of June 2023: €130.8 billion), AuM: €117.9 billion (end of June 2023: €115.2 billion)

- Strong capital ratio of 18.9%, after planned capital return of €2.00 per share (end of June 2023: 21.6%)

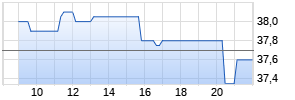

Jeroen Kroes, Van Lanschot Kempen’s Chief Financial Officer, said: “Following a positive stock market climate in the first six months of 2023, the third quarter saw share prices drop. That said, inflows in assets under management (AuM) at Private Clients in the Netherlands and Belgium continue to remain robust, with current and new clients entrusting us with their wealth, driven in part by innovations in our product offering. Private Clients’ Relationship Net Promoter Score stood at 34 by the end of the third quarter – a great tribute to our private bankers’ personal and entrepreneurial approach. Commission income rose on the back of continued solid net inflows in the first nine months, coupled with the acquisition of Robeco’s online investment platform. The fourth quarter will see us retain our focus on further, scalable growth, while maintaining a capital-light balance sheet.”

In the third quarter, Van Lanschot Kempen expanded on its proposition of wealth management with a personal touch, after a successful launch in the second quarter. The proposition provides private banking clients in the Netherlands with a set of core portfolio investments coupled with a selection of specific investments to help them personalise their portfolios as they see fit. In collaboration with Robeco, Van Lanschot Kempen added the Megatrends Fund to its client offering in the third quarter. It also launched its North American Private Equity Fund in October to give clients access to SMEs in North America – a good example of how we make our investment management expertise available to our private clients.

As expected, interest income, including interest charges on medium-term notes, was below the second-quarter figure. Savings were up slightly, with demand for term deposits still growing. Van Lanschot Kempen persisted in its strict cost focus in all its segments throughout the third quarter. Despite continuous growth FTE numbers remained stable, adjusting for the addition of new colleagues in the wake of the acquisition of Robeco’s online investment platform. The integration of these activities is proceeding according to plan, as is the merger of Mercier Vanderlinden and Van Lanschot Belgium.

Van Lanschot Kempen’s capital position remains very strong with a CET 1 ratio of 18.9% (end of June 2023: 21.6%), well above Van Lanschot Kempen’s target of 15% plus an add-on of 2.5% for acquisitions. The decrease in the ratio mainly reflects the recognition of the planned capital return of €2.00 per share and the completion of the acquisition of Robeco’s online investment platform.

The sale of Van Lanschot Kempen’s stake in Movares in the portfolio of participating interests is expected to generate a book profit of around €23 million in the fourth quarter.

FINANCIAL CALENDAR

Ex-date 19 December 2023

Record date 20 December 2023

Payment date 21 December 2023

Publication of 2023 annual results 22 February 2024

Media Relations

Maud van Gaal

T +31 20 354 45 85, mediarelations@vanlanschotkempen.com

Investor Relations

Tosca Holtland

T +31 20 354 45 90, investorrelations@vanlanschotkempen.com

Aktie im Fokus

|

SOL Global Investment Corp

0,26

€

+0,78%  |

Kurse

|

About Van Lanschot Kempen NV

Van Lanschot Kempen is an independent, specialist wealth manager active in private banking, investment management and investment banking, with the aim of preserving and creating wealth, in a sustainable way, for both its clients and the society of which it is part. Through its long-term focus, it creates positive financial and non-financial value. Listed at Euronext Amsterdam, Van Lanschot Kempen is the Netherlands’ oldest independent financial services company, with a history dating back to 1737.

For more information, please visit vanlanschotkempen.com

Important legal information and cautionary note on forward-looking statements

This press release may contain forward-looking statements and targets on future events and developments. These forward-looking statements and targets are based on the current insights, information and assumptions of Van Lanschot Kempen’s management about known and unknown risks, developments and uncertainties. Forward-looking statements and targets do not relate strictly to historical or current facts and are subject to such risks, developments and uncertainties which by their very nature fall outside the control of Van Lanschot Kempen and its management. Actual results, performances and circumstances may differ considerably from these forward-looking statements and targets.

Van Lanschot Kempen cautions that forward-looking statements and targets in this press release are only valid on the specific dates on which they are expressed, and accepts no responsibility or obligation to revise or update any information, whether as a result of new information or for any other reason.

The figures in this press release have not been audited. Small differences are possible in the tables due to rounding. Percentages are calculated based on unrounded figures.

This press release does not constitute an offer or solicitation for the sale, purchase or acquisition in any other way or subscription to any financial instrument and is not a recommendation to perform or refrain from performing any action.

Elements of this press release contain information about Van Lanschot Kempen NV within the meaning of Article 7(1) to (4) of EU Regulation No. 596/2014.

This press release is a translation of the Dutch language original and is provided as a courtesy only. In the event of any disparities, the Dutch language version will prevail. No rights can be derived from any translation thereof.

Attachment

Mehr Nachrichten zur Van Lanschot Kempen NV Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.